This post was sparked by a conversation with my Uncle-in-law following the new and exciting chapter of marriage in my life. One of the first things that he said to me was “Jakir, read Rich Dad Poor Dad’. This may not have had the same level of impact if anyone said it, but he is a multi-property investor so I took it on board!

The first action for me was to read the book; Rich Dad Poor Dad, this book explores:

1.The myth that you need to earn a high income to become rich

2.The reliance school system as a core means of income

3.The true definitions of assets and liabilities

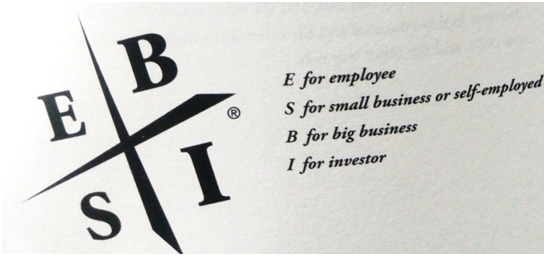

The section of the book which resonated with me the most was Robert Kiyosaki’s “Cashflow Quadrant” as shown below:

This really made me think outside the box. The large majority of us are employees in the rat race for something for ourselves. I want to be part of the S and I because I’ve always wanted to work for myself and be my own boss. The second reason is my interest to invest in stocks which should help my income flowing without having to work so hard!

Before I show you how I applied it and how it’s it helped me, Let’s begin by how my first free workshop on Rich Dad Poor Dad (Bristol Hotel, 15th February 2017).

Firstly, I was very disappointed about the workshop because it was more for people that are in the property business and for those that want to expand their property portfolio. Secondly, it did not focus on the book or its motive. However, I do have a passion for investing and do hold some stocks and bonds; so I kept a positive perspective and stayed to listen more.

The workshop explored the B and I section of Kiyosaki’s Cashflow Quadrant. Referencing to the books; Rule #1:

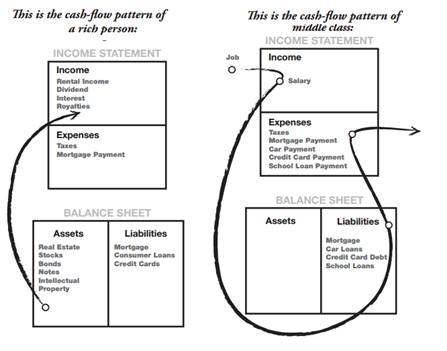

“You must know the difference between an asset and liability, and buy assets.”

The things I learned from the workshop:

*How property planning works

*The key success criteria when acquiring properties

* The importance of saving money and building up your income

How I applied it

Firstly, I took actions setting up an ISA saving and fixed bond accounts. Secondly, I brought stocks within the company I work for and acquired assets which enabled me to make money and lowered my liabilities.

How it’s helped me

My accomplishment so far:

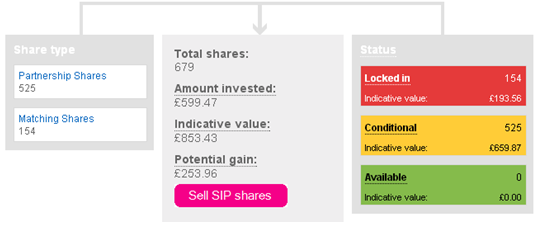

I have gained £253.96 and have stock at an indicative value of £853.43 – That’s just me putting in £100 each month in shares and letting it sit there and making the money work by itself. Plus, I get dividends from it too.

Share value can increase and decrease.

I’ve set up a 2-year premier fixed bond account at 0.80%, which now has a total of £1,500. Last year, in my savings I’ve made £2780.54 alone. So in total, that’s £4,280.54. Not bad from a huge year where I’ve got married and had several holidays in between.

Have a look into this before you invest and here is a good to tool to use to plan your life goals, find out more here.

How I will apply it in the future

Things I will look into doing or do more of:

* ‘Open a Business that doesn’t need my presence, I own them, but they are managed or run by other people. If I have to work there, it’s not my business. It becomes my job.’[Kiyosaki] – Looking into opening an online clothing business – watch this space

* Stocks – invest in some more stocks in different companies

* Bonds – open more fixed bond accounts

* Income – generated properties (future goal) – Within next two years get my own property

* Anything else that has value, produces income or appreciates, and has a ready market

To conclude, I am not an investor. I’ve just become more sensible in investing and my aim is to keep improving! Reading this book and going to workshops related to investment and properties is just the first step.

Each one of us has unique definitions of success and a variety of aims and objectives. I followed my goals and I plan to enhance my income. It’s working and I will keep going until I’ve achieved my future ambitions. What’s stopping you?

Find me on Linkedin.

Fancy becoming part of the inspirEnrich contributor family? 😀 head over to here: inspirenrich.com/contribute