It’s been a year since I wrote the article ‘How “Rich Dad Poor Dad” is helping me excel in life’. So, it’s about time for the follow-up on my Wins, Losses and Future Investment Goals from the past year inspired by Robert Kiyosaki’s book, which I adapted to my own lifestyle.

Firstly, I’m going to cover what I said I’ll do 12 months ago and then go on from there:

- Opening a business

- Stocks and bonds

- Generating extra income

- Future goals

1. Opening a business

This was very ambitious but I’ve managed to get involved with a start-up business helping my brother with his online clothing business Krokodil Ltd. Whilst my brother handled the design aspects I made the E-commerce platform and manage the social media platforms. You can now find Krokodil on Facebook, Instagram, and Youtube. Watch out for a post on this in the future, for, now enjoy the below:

2. Stocks and bonds

Not all the stories were successes; highlighted with my investments into stocks using my banks’ investors’ tool. This tool allows you to buy stocks and shares from small upcoming companies that are available on the London stock exchange. It’s very good starting point but it is very time consuming and you definitely need to do your research before investing.

I ended up losing some money. To use the banking tools online they charge £4.99 per month. I invested £500 but I ended up losing all the money. Sometimes, there’s not always a gain to investments but like Robert Kiyosaki says:

“Fail harder. You cannot be successful without Failure”.

Check out the update on my current Sabadell shares, which I bought from my workplace partnership scheme:

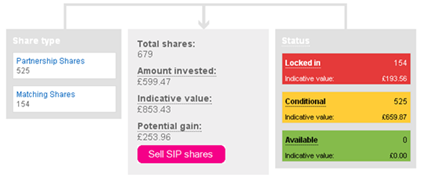

2017

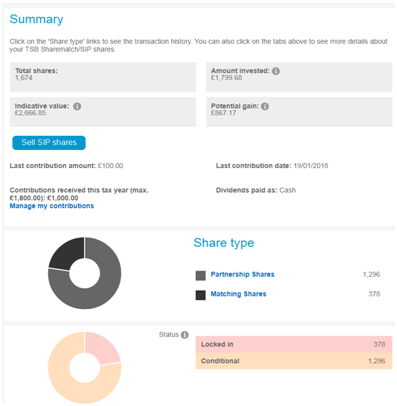

2018

In 2017 I had 678 shares, which has more than doubled to 1674 shares which is valued at £2, 666.85 not bad for doing nothing but depositing cash and letting it grow. Share value can increase and decrease. Have a look into this before you invest and there are good to tools to use to plan your life goals, find out more here.

Fixed bond account – not much success here neither, I’ve still got an ISA, that’s giving me 0.8% and the 2 year fixed bond account that is still maturing. However, I do need to focus more on my bond assets by being savvier and manage my risks better which will allow me to put some more money into the fixed savings available to me.

3. Generated extra income

This refers to anything else that has value, produces income or appreciates, and has a ready market. Selling used stuff on eBay – Recommended by a couple of my mates and it’s worked a treat. I’ve initially earned £199.98 in 30days. Take a read how to do it easily here.

To conclude on Robert Kiyosaki’s cashflow quadrant:

I am definitely working towards Business and Investment (B&I). In terms of the 7 levels of investors, I would put myself in the higher level 3 going to Level 4. I need to get more serious and educated about where to put my money. I need to map out my long-term goals with financial transformation.

4. Future goals

My long-time goal is still getting on the property ladder with house prices rising and base rates dropping still a long way to go. Hopefully, my investments will pay off to get on that ladder. I’ve been hearing a lot about Cryptocurrencies? Is this the new future for investors? I’ve been researching into Bitcoins, Either, Ripple, Monero and Litecoins and others. If that’s your area get in touch with me!

To conclude, I am not an investor. I’ve just become more sensible in money management and looking for a good return on investment. My aim is still to keep improving! reading books and learning from mentors around me is just another step to growing my wealth and sharing my success with you is my end game!

Fancy becoming part of the inspirEnrich contributor family? 😀 head over to here: inspirenrich.com/contribute